Costa Rica Property Ownership

What are the Costa Rica property ownership rights as a foreign investor? by REMAX Oceanside Realty based out of Jaco Beach Costa Rica

PURCHASING & OWNING COSTARICAN PROPERTY

In Costa Rica there are generally no restrictions for foreigners or foreign entities purchasing property as the Costa Rican constitution grants foreigners the same Costa Rica property ownership rights as that nationals have. Therefore, you can purchase fee simple, fully titled property with the same ownership rights as you have in North America. The exception is if you are purchasing concession property that is detailed in a later section. If you purchase a property within a condominium regime then you would be subject to the bylaws within that community and restrictions and obligations may include whether or not pets are allowed, voting rights, monthly home owners fees, specifications on what is allowable in the front yard or terrace, etc.

When purchasing real estate in Costa Rica, proper registration of the property and the transfer deed is of great importance. All Costa Rican property is registered with a central institution called the National Registry and they hold public records that certify who owns the property as well as information related to the parcel such as its location, measurement, boundaries, survey map, liens and mortgages. In order to transfer a registered property, the recorded owner must appear before a Notary Public and grant a public conveyance deed that must be presented and recorded before the National Registry. The purpose of the National Registry is to guarantee the security of registered property rights.

Concession Property | Costa Rica property ownership

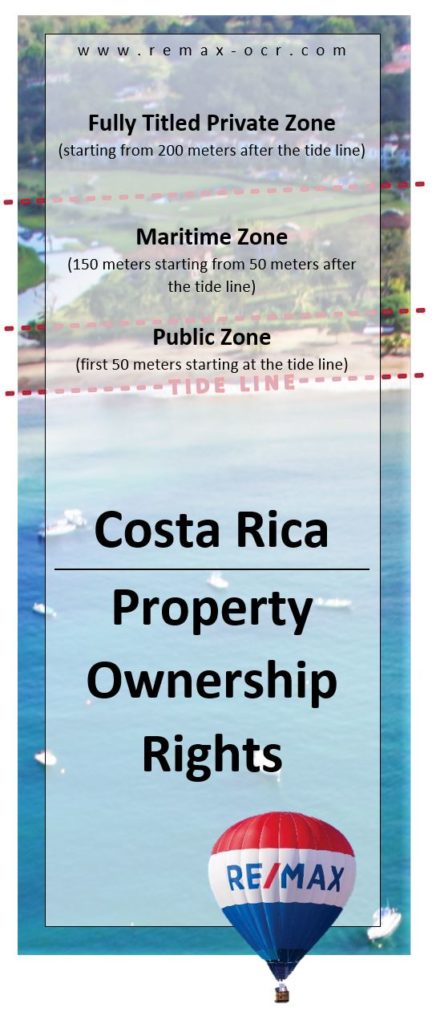

The exception to fee simple property is if you are purchasing within 200 meters of the ocean because in most of the country that is concession land or leased land from the government. The first 50 meters from the mean high tide mark is government owned property and therefore no one can ever build or encumber that area. The next 150 meters in 95% of Costa Rica is referred to as the Maritime Zone that may be developed via special “concessions” that are granted by the local municipality. Typically, the concession term is for 20 years during which time you pay an annual concession fee. When the concession expires you can apply to renew the concession, but the municipality can elect to purchase the property at the assessed value in lieu of renewing the concession. It is important to know that you are not purchasing property in this zone but you are simply leasing it without any title.

The exception to fee simple property is if you are purchasing within 200 meters of the ocean because in most of the country that is concession land or leased land from the government. The first 50 meters from the mean high tide mark is government owned property and therefore no one can ever build or encumber that area. The next 150 meters in 95% of Costa Rica is referred to as the Maritime Zone that may be developed via special “concessions” that are granted by the local municipality. Typically, the concession term is for 20 years during which time you pay an annual concession fee. When the concession expires you can apply to renew the concession, but the municipality can elect to purchase the property at the assessed value in lieu of renewing the concession. It is important to know that you are not purchasing property in this zone but you are simply leasing it without any title.

In the case of properties located in the restricted zone of the Maritime Zone, a foreign person can only be the beneficiary of 49% of the concession’s rights meaning that a corporation would need to be used. It is common for foreigners to set up a corporation with a Costa Rican member of the corporation owning 51% but we no power over the corporation.

THE GOOD NEWS! The entirety of Jaco Beach is fully titled up to the 50 meter mark as is a good portion of Hermosa Beach and also in Herradura where the Los Suenos Resort Marina is located. We are lucky to have this amount of titled oceanfront property in the Central Pacific due to the fact that these properties were registered prior to the 1977 Maritime Zone law.

Buying real estate using corporations

As a foreigner you are able to purchase titled property in your personal name but there are benefits of acquiring property through a Costa Rican corporation. The main advantage is that you can limit any personal liability to your property by owning in a corporation. Under Costa Rica law, corporations are separate legal entities regardless of ownership of stock or other forms of relationship so the so called “corporate veil” is respected.

Another advantage of owning in a corporation as a foreigner is that you can easily grant a power of attorney via a proxy that can be scanned and emailed. This power of attorney can be granted to any individual to perform operations on behalf of the corporation such as changing the name on a utility bill or purchasing or selling property. For that reason, you do not need to be present in Costa Rica in order to sign the transfer deed in order to buy or sell property and everything can be done from abroad.

Lastly, It is sometimes not possible for foreigners to obtain utilities in their personal names but it can be done via a Costa Rican corporation.

A corporation can be established in a matter of a day or two and you are able to select the name of the company as long as your choice is not already in use. Corporations are subject to an annual tax that will depend on whether or not the corporation is “active” or “inactive.” A corporation should be “active” if it has any income generating activity such as vacation rentals and the annual tax for an active company is approximately $190. An inactive company will pay approximately $115. There are two main types of corporations that are usually incorporated in Costa Rica called the Sociedad Anonima (S.A.) and the Sociedad Responsabilidad Limitada or Limited Liability Company (S.R.L.). Below are the differences between the two and an attorney can advise you as to which structure is the most beneficial depending on your personal goals and circumstances.

I. Costa Rica property ownership through a “Sociedades Anónimas (S.A.)”

A. Corporate Stock:

- The corporate stock shall be composed of a determined amount of common stock shares, with voting rights. Preferential shares may also be issued with limited or additional rights.

- Shares in an S.A. shall be transferred by endorsement. Such transfer shall also be registered on the Shareholders Registry Book

B. Administration:

- The Stockholders Meeting is the maximum corporate authority. Representation for said Meeting may be authorized through proxy letters.

- The Board of Directors acts as the Board of the company and also performs the duties of a Corporate Executive Committee as it would in U.S corporations. Said Board must have a minimum of three members, which are President, Secretary and Treasurer; their faculties shall be established in the articles of incorporation.

- A comptroller must be appointed to oversee the adequate management of the company.

II. Costa Rica property ownership through a “Sociedades de Responsabilidad Limitada (S.R.L.)”

A. Corporate Stock:

- The corporate stock shall be composed of a determined amount of nominative shares. Preferential quotas may be also issued; with limited or additional rights.

- Quotas in a S.R.L. cannot be transferred by endorsement. Transfer is performed by means of a Share Transfer Agreement, which is subject to the approval of the remaining quota holders. Such transfer shall also be registered on the Quota holders Registry Book. Please take note that the remaining shareholders have the right of first refusal over an eventual share transfer.

B. Administration:

- The Quota holders’ Meeting is the maximum corporate authority. Representation for said Meeting may be authorized through proxy letters.

- S.R.L.´s are managed by one or more managers or vice-managers. Said representatives will be empowered with the faculties granted through the articles of incorporation. In addition, Costa Rican law prohibits such managers or vice managers to represent other companies with similar economic activities, or to carry out such activities on their personal behalf.

C. Tax Purposes:

- S.R.L. may be treated either as a corporation or as a partnership under Regulations to Sections 301.7701-1 through 4, of the United States of America

Continue Reading the Costa Rica Real Estate Guideline…

Please let us know if we can assist with any questions or help with any of your Costa Rica real estate needs!

Costa Rica Real Estate Starter Guide | Community Reviews

|